Sell Your House Quickly And Simply

in 28 Days With £0 Fees

If you want to sell your house fast and get the best possible offer, you are at the right place!

Get Cash Offer NOW or Call Julie 0161 258 7486

or Call Julie 0161 258 7486

Shared Equity Ownership in real estate, also known as “fractional ownership”, is when one or more properties are divided into shares that belong to several investors. By doing so, it opens the door to luxury property for medium budget buyers for a fraction of what it would actually cost to own an own elite pad. It is a lucrative way to splash out on luxury holidays and earn capital gains without Airbnb but there are some risks involved.

Companies offering this service usually have a variety of properties in their portfolio, from designer flats in Europe’s classiest cities to private villas in exclusive Caribbean resorts. In America, some companies sell places in luxury chains of private golf clubs and ski resorts. The schedule, maintenance, cleaning and bills are handled by a professional property management company, which also eases the burden on shareholders.

Seven benefits of shared ownership

Fractional ownership actually began a few decades ago when investors started going in on yachts and private jets together, a practice that still lives on today. Over recent years, the model has branched out in property and is now seeking to tap into the middle income buyer segment. These are people looking for a reliable investment that grows in value now that interest rates on savings accounts are so low that they have become irrelevant.

Luxury shared ownership structures are organised and managed by an investment fund specialising in real estate. There are a number of companies offering this type of strategy but because of the similarities with the “time share” scheme, it is important to research the investment correctly.

100% of a shared equity property is owned by investors, meaning that you collect the profits when it is sold on. There is a limited number of participants which makes it easier to manage and ensures that every person is treated appropriately.

The standard “shelf life” of a property is 7–10 years, after which it is sold on and the capital gains are shared among the investors. Shareholders also enjoy rent-free holidays from 10 days to four weeks (depending on the location and percentage owned).

There are two main types of shared equity investment plans that generally depend on the continent where the property is located.

For example, in Europe investors tend to choose residences in major capitals and cities like Paris, Milan, Berlin, or villas in the South of France, Capri and Spain’s Costa Blanca. No doubt, these choices are made more attractive by cheap flights, easy connections, great cultural attractions and nightlife.

In the United States and Canada, it’s common to find funds (including developers) offering both individual properties and shares in resorts like the Four Seasons and Ritz-Carlton. The terms and requirements can vary especially if you invest in one of these chains, because shareholders can “mix and match”, trading in their stay at a property in Miami with a resort in the Caribbean for instance.

There are two main ways to structure ownership: either via “direct-deeded ownership” where every shareholders name appears on the title deed or via an LLC (limited liability company) that often has preferential tax options. The latter also makes it easier to exit the investment early because you can sell on (transfer) your share if needs be. Co-owners generally get first dibs if you decide to sell.

The investor puts down €250,000 to co-own one property in a portfolio of six different destinations, and gets an allowance of 28 days per year to spend in one of the portfolio residences. The estimated value of the property invested in is approximately €1,500,000. Maintenance, tax and services costs are divided between shareholders so each party pays €5,000 annually, instead of €30,000. Capital gains upon selling the property are 15% (based on property price growth of 2%* per year over 7 years) so the investor would leave with €287,500 – making a profit of €37,500.

In contrast, spending 28 days per year in a luxury accommodation would cost €8,400 conservatively per year (based on €300 per day), or €58,800 over 7 years.

*This is a conservative estimate. According to Knight Frank, prime property prices grew at a rate of 3% per year in 2015.

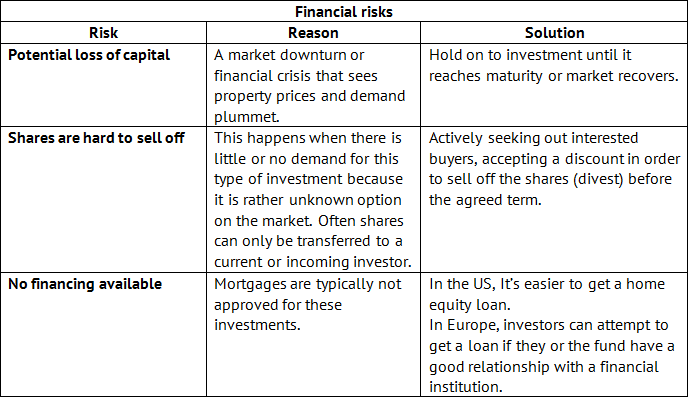

There are several risks however with this type of investment and real estate in general. By taking them into account before choosing where to invest and whether it is worth is, you will be able to choose the most profitable (or least costly) exit strategy in case of early divestment.

There are also some inconveniences that are worth accounting for. For example, the summer and school holiday periods are always in high demand, meaning that it will be harder to organise your holiday during these periods. At the same time, some investors tend to forget what they own is actually a share and not a whole property. Because it is shared among many people and entrusted to a management company, shareholders are not free to modify, decorate or adapt it to their personal tastes.

Shared equity ownership at this level is very competent at staying ahead of the curve and it doesn’t just mean they are adding more spa properties and serviced accommodation to their portfolios. Many providers have switched their attention to humanity’s new imperative: flexibility, so expect to new options in the coming future such as nightly rather than weekly bookings, smaller share sizes, short-term shares, clean-cut exit strategies, and full service accommodation.

Related Posts: